Home » Industries » Insurance Technology Services » Technology Offerings

Technology Offerings

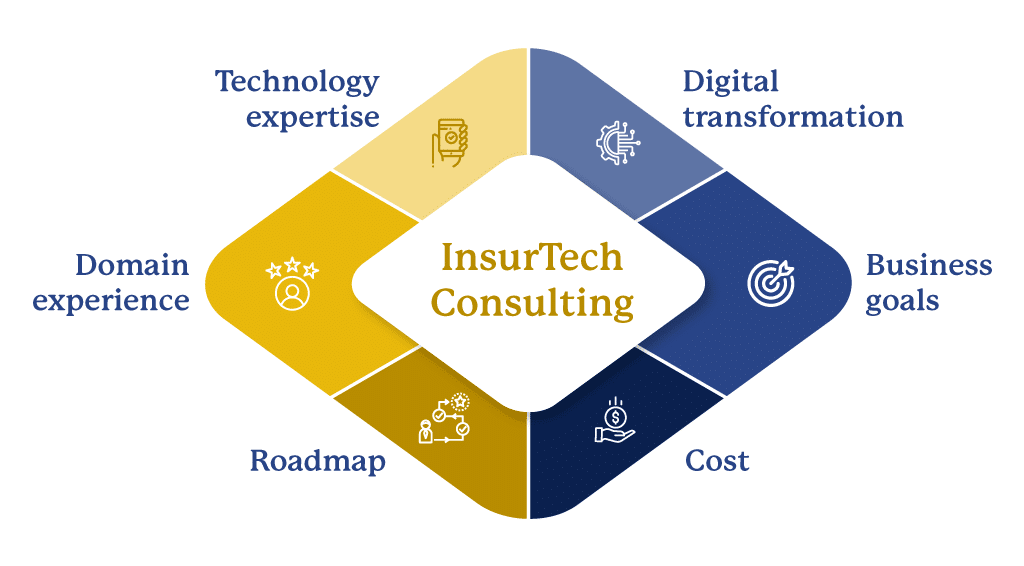

Consulting and System Transformation

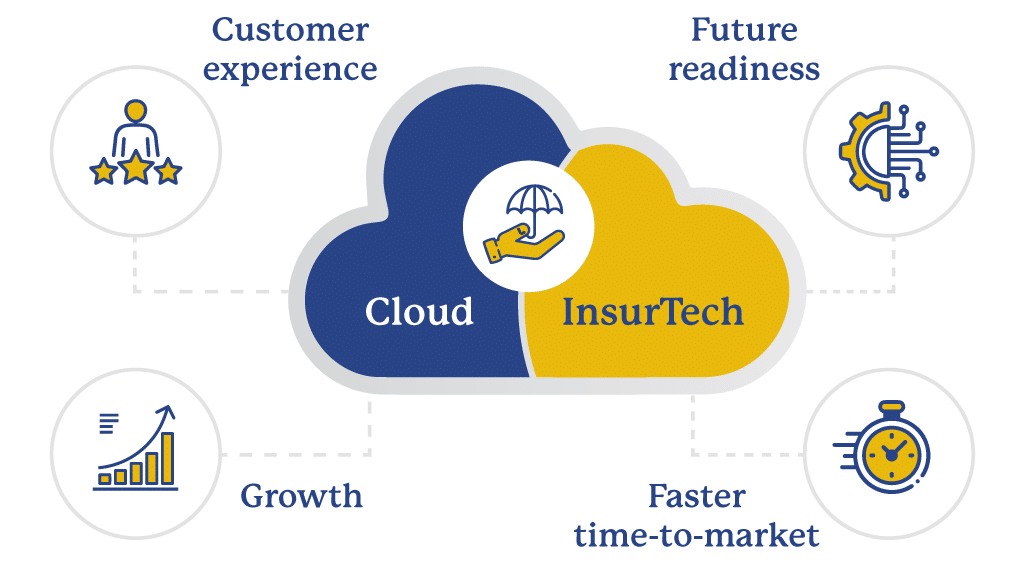

Cloud Migration and Tech Modernization

With extensive expertise in rendering digital transformation services, Iris delivers dependable systems and technology modernization solutions for insurance businesses. In line with the changing technological landscape of the Insurance industry, we transform the existing systems into future-ready applications through re-platforming, re-factoring, and cloud-native re-writing. We have enabled several insurance companies to capitalize on greater business opportunities by migrating on-premise estate and application infrastructure to cloud. Our grey screen application modernization makes them accessible on hand-held devices, allowing insurers to expand their outreach multifold at a reduced total cost of ownership (TCO). Iris Insurance technology and systems modernization services span the following critical systems:

- Customer Relationship Management

- Agent and Consumer Management

- Enterprise Resource Planning (ERP)

- Workforce Management

- Service Management and Workplace Services

- Insurance SaaS (Software as a Service) Applications

- Applicant Management

- Insurance Catalogue and Asset Management

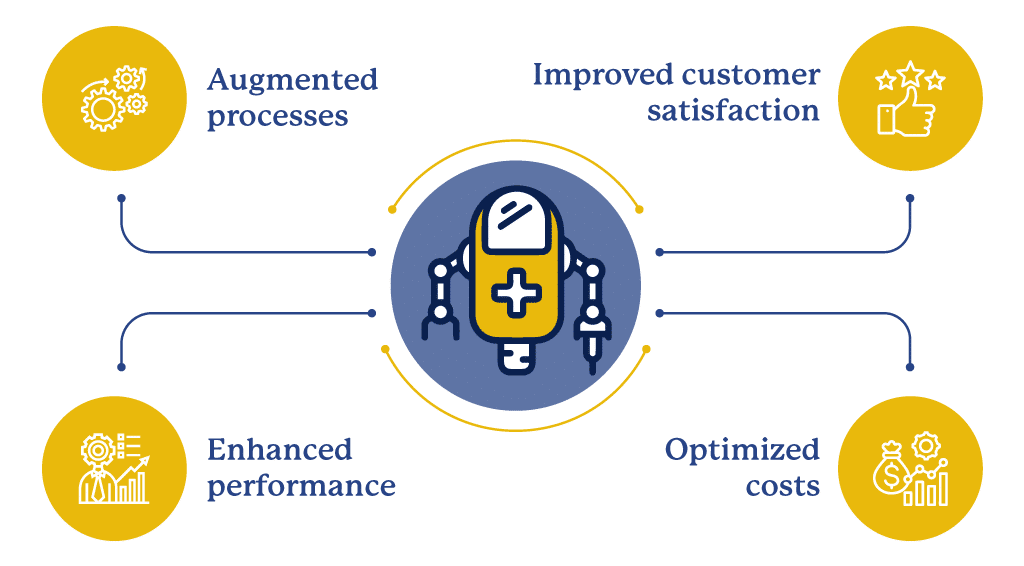

Robotic Process Automation

Robotic Process Automation (RPA) offers agility to any business by transforming mundane, repetitive, transactional, and several administrative tasks into trained, scripted procedures. Insurance processes automation provides the ability to pivot as per changing needs of micro and macro-economic factors. Iris helps insurers achieve enormous business benefits, including customer onboarding, KYC (Know-Your-Customer), claim processing and customer experience through seamless RPA implementations. Our automation services have assisted several Fortune 500 insurance companies in scaling their performance while significantly reducing business overheads. Some of the insurance businesses process automation use cases that Iris has invested in include:

- End-to-end claims processing and management

- Insurance operations transformation

- Claims and policy underwriting

- Sales and business development (campaigns and promotions)

- Customer support requests management

- Insurance and reinsurance

- Rate adjustments following changes in micro and macro-economic factors

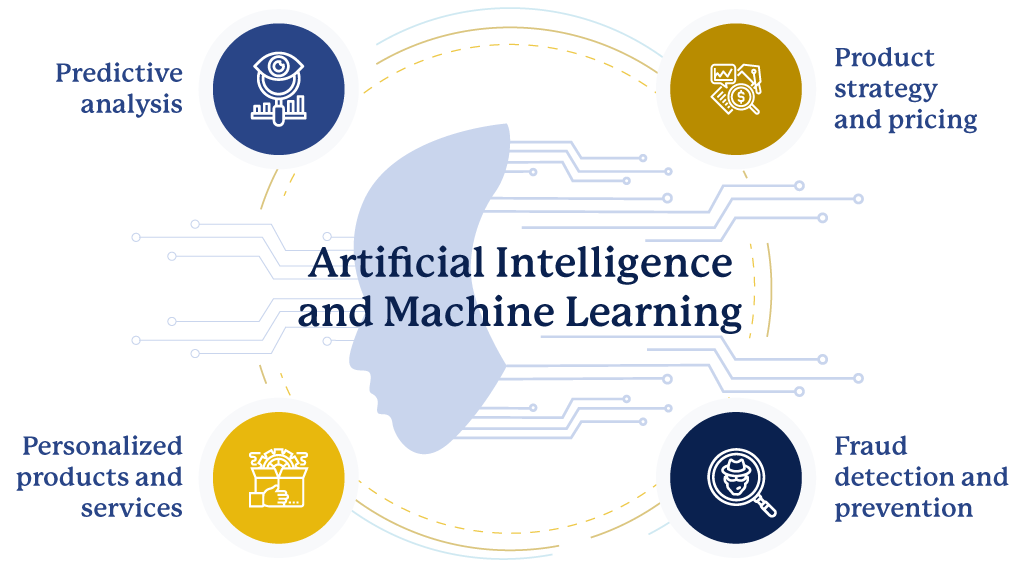

Artificial Intelligence and Machine Learning

- Predict market risks

- Improve insurance distribution, liability and risk identification processes

- Strategize product pricing and associated risks

- Segment customers based on various factors

- Personalize offerings based on customers’ historical and behavioral data

- Predict customer lifetime value

- Balance workstreams for agents

- Detect frauds at early stages and forecast volumes

- Inspect and analyze damages

- Reduce turnaround time by deploying self-learning virtual and live agents

Contact Us

Thank you for getting in touch

We appreciate you contacting us. We will get back in touch with you soon.

Have a great day.

Industries

Company

Bring the future into focus.